Retirement Planning

Zirkelbach Financial Solutions

Retirement is personal. You’ve worked hard to save and invest your money and now it’s time to optimize and protect your savings to provide for your retirement and your loved ones thereafter.

Zirkelbach Financial Solutions is an independent financial services firm, specializing in helping individuals and families prepare for, plan, and live in retirement. Our approach focuses on tailored retirement planning strategies and insurance solutions to provide our clients with guaranteed lifetime income, asset protection, and achieve tax efficiencies in support of a holistic approach to their finances.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

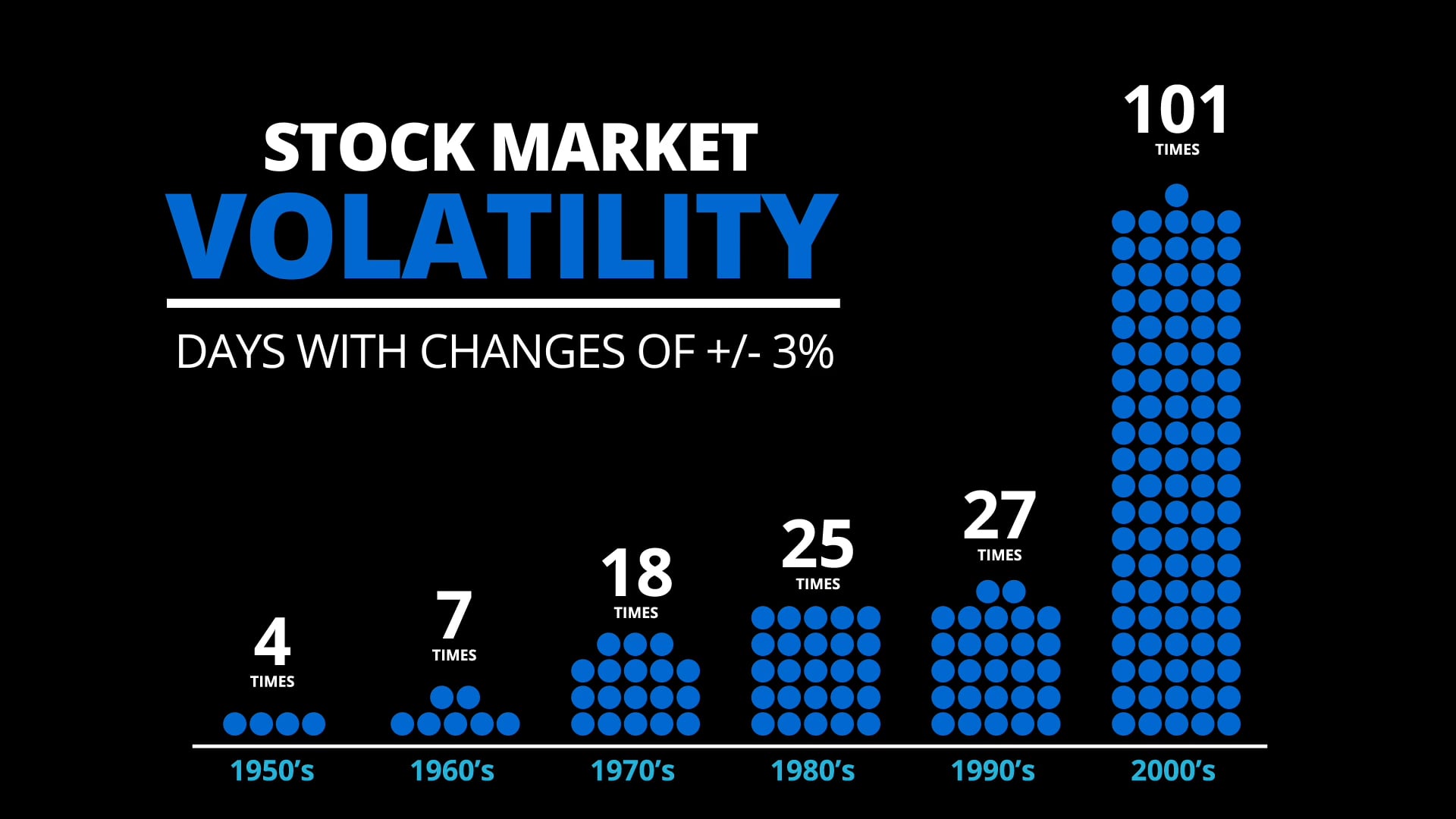

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Curtis Zirkelbach

Estate Planning Consultant and Licensed Insurance Agent

Curtis Zirkelbach is a seasoned Estate Planning Consultant, Licensed Insurance Agent, and the founder of Zirkelbach Financial Solutions, a firm dedicated to helping clients navigate the complexities of estate planning and asset protection. With over 25 years of experience in the insurance and financial services industry—including 15 years as an estate planning consultant—Curtis brings a wealth of knowledge to his practice. He specializes in crafting comprehensive estate plans, facilitating trust funding, and ensuring the proper execution of essential legal documents. While not an attorney or CPA, Curtis collaborates closely with estate planning attorneys, CPAs, and third-party software professionals to deliver tailored solutions that provide clients with peace of mind and protect their legacies.

Curtis’s expertise is grounded in his extensive background in Life & Health and Property & Casualty Insurance, bolstered by his LUTCF (Life Underwriter Training Council Fellow) designation. Committed to lifelong learning, he is currently pursuing a Master’s in Certified Financial Planning from the American College of Financial Services, with plans to earn his Estate Planning and Tax Certification. His academic foundation includes studies in accounting and business at Southern Illinois College, Henderson Community College, and the University of Southern Indiana.

Born and raised in Illinois, Curtis graduated from Shawneetown High School in 1988 and began his career working in the field of mental retardation and developmental disabilities. In 1997, he transitioned into the insurance industry, where he honed his skills before founding Zirkelbach Financial Solutions in 2010. His firm was established to provide unbiased insurance solutions, offering a diverse range of products from highly reputable carriers. Curtis focuses on safe money investments, tax-free income strategies, and estate planning consultations to help clients achieve their financial goals.

Beyond his professional achievements, Curtis is deeply committed to serving his community. He has volunteered with organizations such as Marsha’s Place Pregnancy Resource Center, the American Cancer Society, and Samaritan’s Purse Disaster Relief. He has also supported numerous church-based initiatives, including mobile pantries and ministries for the unhoused. As the first male Court Appointed Special Advocate (CASA) in Henderson, KY, Curtis has demonstrated his dedication to advocacy and service. His passion for missions has led him to participate in multiple trips to Yangon, Myanmar, and to support both local and foreign missions through his church.

At Zirkelbach Financial Solutions, Curtis’s mission is to deeply understand his clients’ unique needs and the external factors impacting them. This enables him to recommend the best products and strategies from highly respected insurance companies, ensuring the protection and growth of his clients’ assets. His firm is built on a foundation of dignity, respect, confidentiality, and professionalism, fostering long-term consultative relationships that secure clients’ legacies for future generations.

Curtis’s unwavering dedication to his clients, community, and continuous learning makes him a trusted advisor in estate planning and financial solutions. Whether you’re planning for retirement, protecting your assets, or ensuring your legacy, Curtis is here to guide you every step of the way.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in November 2025

- There are no events scheduled during these dates.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.